GOLD futures drops by 0.53% and SILVER futures by 0.24%, while CRUDEOIL futures gains by 1.34% on MCX

MCXBULLDEX futures reaches at 23404: MCX records turnover of Rs.11275 crores in Commodity Futures & Rs.54360 crores in Options

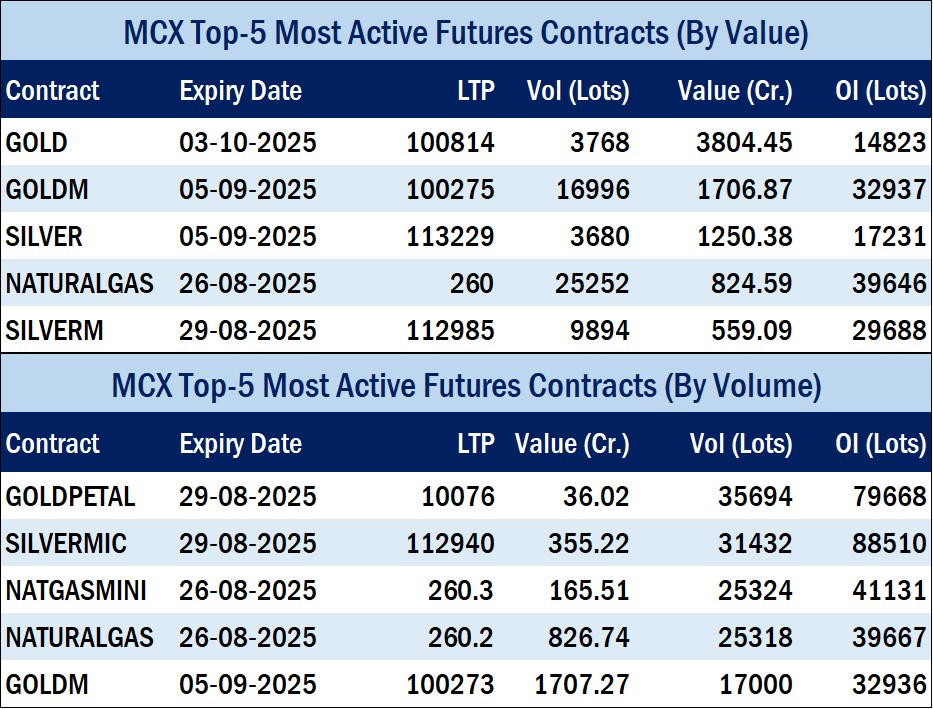

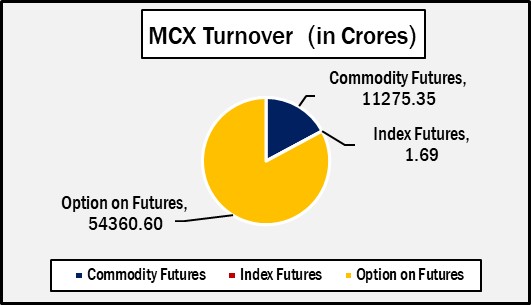

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.65637.64 crores in various futures & option contracts for commodities listed at MCX on Wednesday, August 06, 2025 till 4:15 pm. In which commodity futures accounted for Rs. 11275.35 crores and options on commodity futures for Rs. 54360.6 crores (notional). Bullion Index MCXBULLDEX Aug-25 futures was reached at 23404.

Commodity Future Contracts:

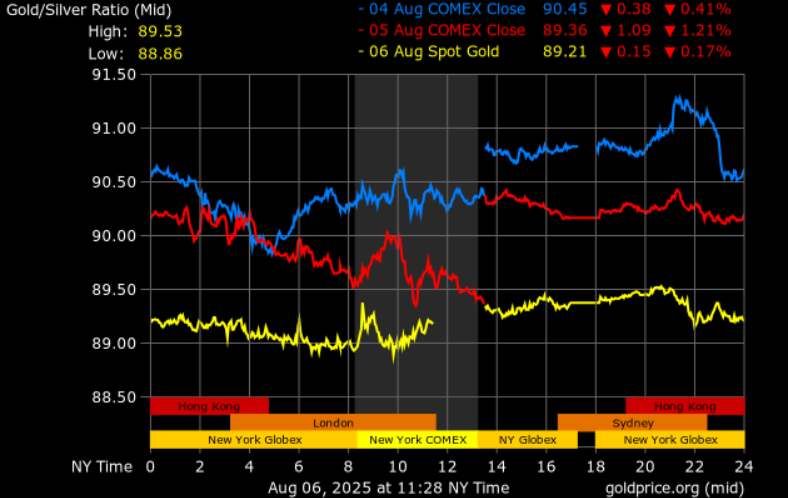

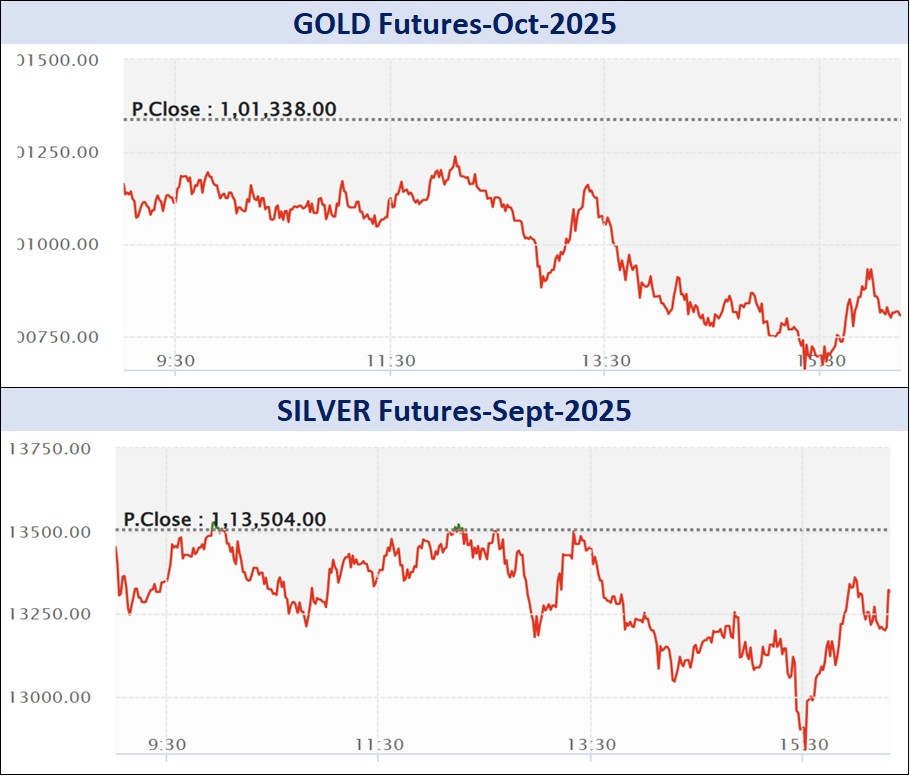

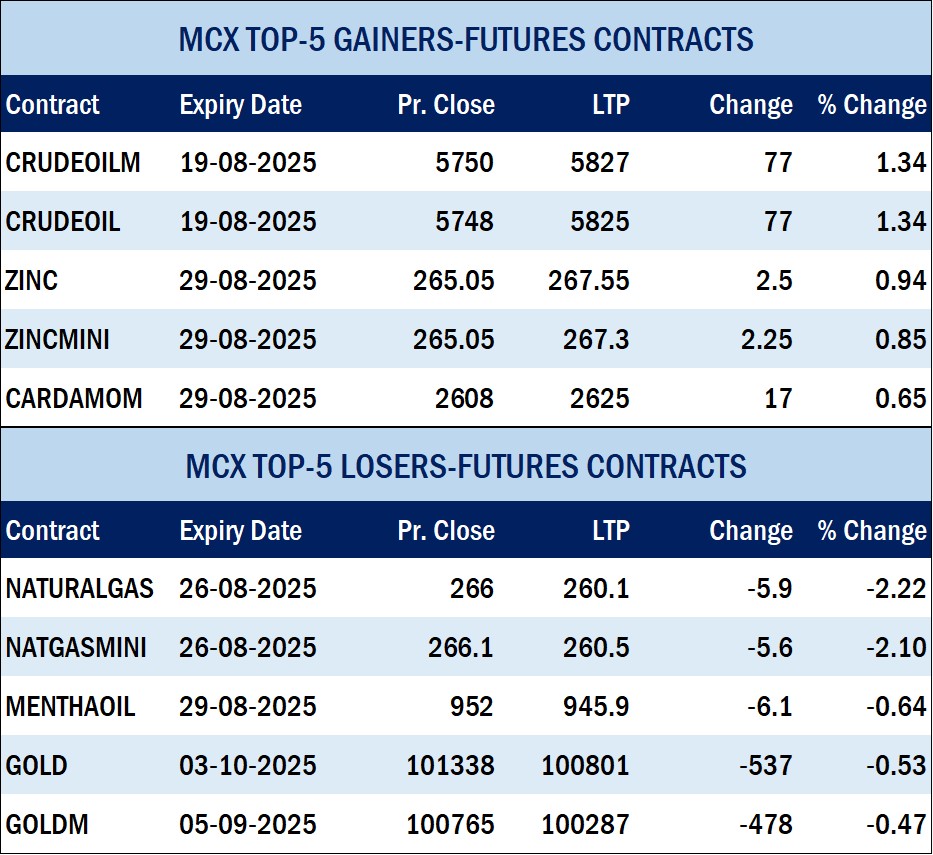

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 8986.83 crores. At the time of writing, MCX GOLD futures, with October-2025 expiry contract was down by Rs.537 or 0.53% to Rs. 100801 per 10 gram, GOLDTEN August-2025 contract was down by Rs.460 or 0.46% to Rs. 100430 per 10 gram, GOLDGUINEA August-2025 contract was down by Rs.295 or 0.37% to Rs. 80497 per 8 gram and GOLDPETAL August-2025 contract was down by Rs.37 or 0.37% to Rs. 10080 per gram.

SILVER futures, with September expiry contract was down by Rs.276 or 0.24% to Rs. 113228 per kg, while SILVERM August-2025 contract was down by Rs.215 or 0.19% to Rs. 112995 per kg and SILVERMIC August-2025 contract was down by Rs.242 or 0.21% to Rs. 112960 per kg.

GOLD futures clocked turnover of Rs. 4039.07 crores with volume of 3998 lots and OI of 15658 lots while SILVER futures clocked turnover of Rs. 1366.07 crores with volume of 4015 lots and OI of 20751 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 600.50 crores. COPPER August-2025 contract was up by Rs.2.9 or 0.33% to Rs. 883.6 per kg and ZINC August-2025 contract was up by Rs.2.5 or 0.94% to Rs. 267.55 per kg while ALUMINIUM August-2025 contract was up by Rs.0.9 or 0.36% to Rs. 252.25 per kg and LEAD August-2025 contract was up by Rs.0.65 or 0.36% to Rs. 180.65 per kg.

COPPER futures clocked turnover of Rs. 337.49 crores, ALUMINIUM futures Rs. 62.36 crores, LEAD futures Rs. 17.96 crores, and ZINC futures clocked turnover of Rs. 128.97 crores.

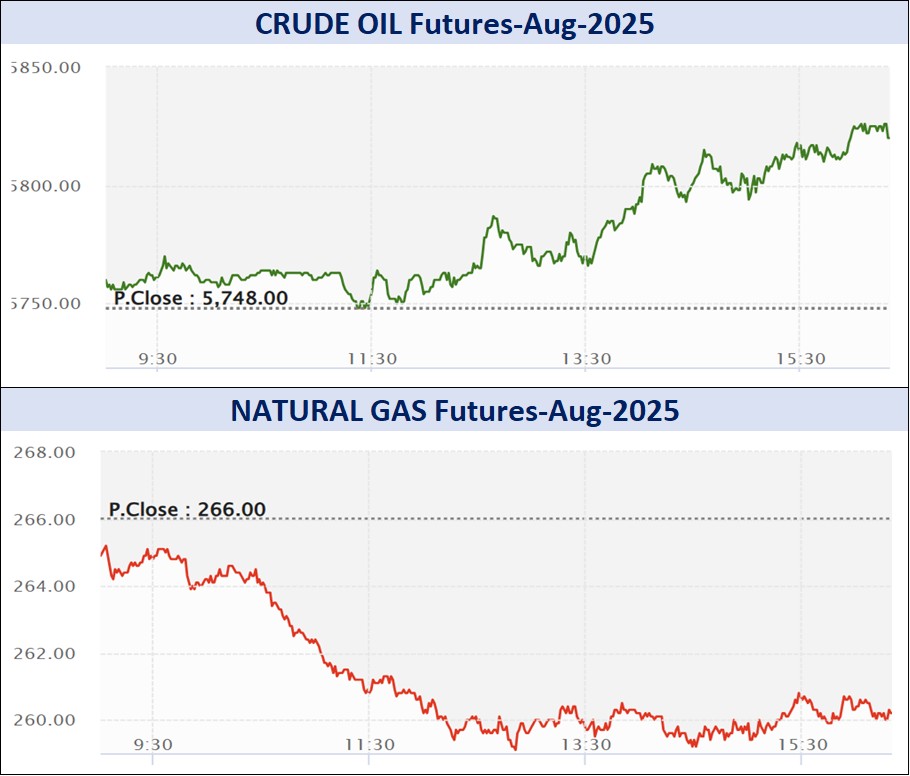

Energy: Turnover of energy futures products contributed for Rs. 1539.61 crores. CRUDEOIL August-2025 contract was up by Rs.77 or 1.34% to Rs. 5825 per BBL while NATURALGAS August-2025 contract was down by Rs.5.9 or 2.22% to Rs. 260.1 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 366.41 crores and NATURAL GAS futures Rs. 912.63 crores.

AGRI: MENTHAOIL August-2025 contract was down by Rs.6.1 or 0.64% to Rs. 946 per kg .

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 54360.6 crores turnover (notional), having premium turnover of Rs. 861.62 crores.

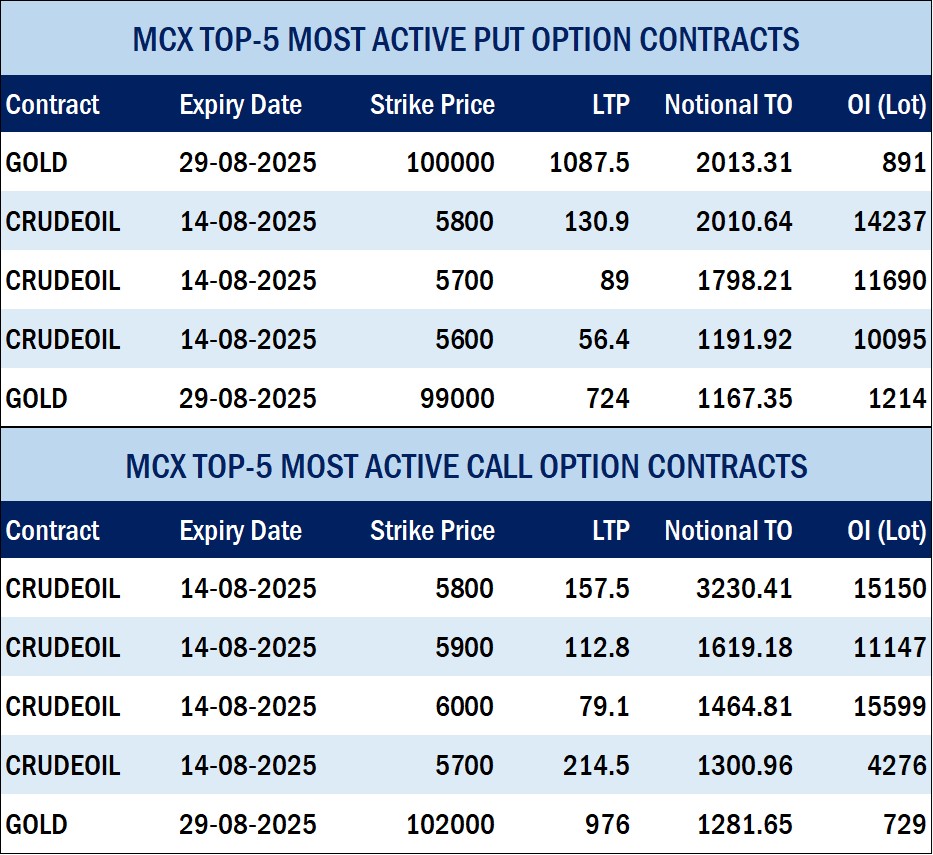

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option August contract at Strike price of Rs.5800 was up by Rs.35.2 or 28.78% to Rs. 157.50 with volume of 54364 lots & OI of 15150 lots, while CRUDE OIL Put Option August-2025 contract at Strike price of Rs.5800 was down by Rs.43.5 or 24.94% to Rs. 130.9 with volume of 33811 lots & OI of 14237 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option August contract at Strike price of Rs.260 was down by Rs.3.4 or 19.37% to Rs. 14.15 with volume of 14288 lots & OI of 8368 lots, while NATURAL GAS Put Option August-2025 contract at Strike price of Rs.260 was up by Rs.2.65 or 23.14% to Rs. 14.1 with volume of 15586 lots & OI of 7372 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option August-2025 contract at Strike price of Rs.102000 was down by Rs.183 or 15.79% to Rs. 976 with volume of 1244 lots & OI of 729 lots, while GOLD Put Option August-2025 contract at Strike price of Rs.100000 was up by Rs.213 or 24.36% to Rs. 1087.5 with volume of 1993 lots & OI of 891 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option August contract at Strike price of Rs.120000 was down by Rs.54.5 or 8.32% to Rs. 600.5 with volume of 492 lots & OI of 1309 lots, while SILVER Put Option August-2025 contract at Strike price of Rs.113000 was up by Rs.136 or 6.17% to Rs. 2339 with volume of 576 lots & OI of 328 lots.