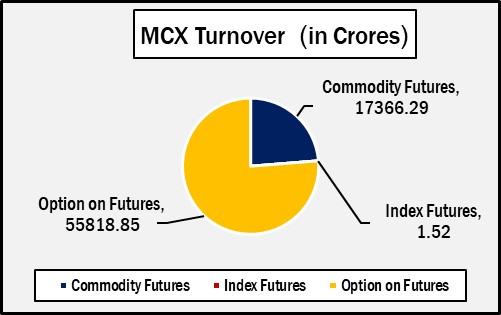

turnover of Rs.17366.29 crores in Commodity Futures & Rs.55818.85 crores in Options

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.73186.66 crores in various futures & option contracts for commodities listed at MCX on Tuesday, June 17, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 17366.29 crores and options on commodity futures for Rs. 55818.85 crores (notional). Bullion Index MCXBULLDEX Jun-25 futures was reached at 23152.

Commodity Future Contracts:

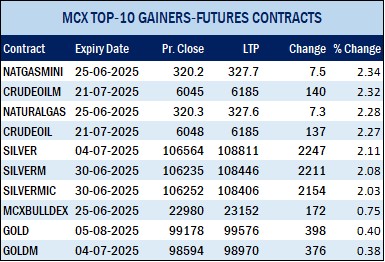

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 14692.97 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was up by Rs.398 or 0.4% to Rs. 99576 per 10 gram, GOLDTEN June-2025 contract was up by Rs.348 or 0.35% to Rs. 99180 per 10 gram, GOLDGUINEA June-2025 contract was up by Rs.229 or 0.29% to Rs. 79631 per 8 gram and GOLDPETAL June-2025 contract was up by Rs.36 or 0.36% to Rs. 9977 per gram. On other hand, GOLDM July-2025 contract was up by Rs.376 or 0.38% to Rs. 98970 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.2247 or 2.11% to Rs. 108811 per kg, while SILVERM June-2025 contract was up by Rs.2211 or 2.08% to Rs. 108446 per kg and SILVERMIC June-2025 contract was up by Rs.2154 or 2.03% to Rs. 108406 per kg.

GOLD futures clocked turnover of Rs. 4810.38 crores with volume of 4847 lots and OI of 16691 lots while SILVER futures clocked turnover of Rs. 4109.34 crores with volume of 12691 lots and OI of 24957 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1520.03 crores. COPPER June-2025 contract was up by Rs.1.45 or 0.17% to Rs. 880 per kg and ZINC June-2025 contract was down by Rs.0.05 or 0.02% to Rs. 252.4 per kg while ALUMINIUM June-2025 contract was up by Rs.0.75 or 0.31% to Rs. 243.2 per kg and LEAD June-2025 contract was down by Rs.1.15 or 0.64% to Rs. 178.55 per kg.

COPPER futures clocked turnover of Rs. 1004.65 crores, ALUMINIUM futures Rs. 185.81 crores, LEAD futures Rs. 26.16 crores, and ZINC futures clocked turnover of Rs. 210.06 crores.

Energy: Turnover of energy futures products contributed for Rs. 2804.05 crores. CRUDEOIL July-2025 contract was up by Rs.137 or 2.27% to Rs. 6185 per BBL while NATURALGAS June-2025 contract was up by Rs.7.3 or 2.28% to Rs. 327.6 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 1388.15 crores and NATURAL GAS futures Rs. 1031.87 crores.

AGRI: MENTHAOIL June-2025 contract was up by Rs.1.6 or 0.17% to Rs. 923 per kg .

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 55818.85 crores turnover (notional), having premium turnover of Rs. 1268.49 crores.

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option July contract at Strike price of Rs.6200 was up by Rs.66.6 or 21.04% to Rs. 383.20 with volume of 24083 lots & OI of 3657 lots, while CRUDE OIL Put Option July-2025 contract at Strike price of Rs.6000 was down by Rs.46.7 or 13.48% to Rs. 299.8 with volume of 18895 lots & OI of 3728 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option June contract at Strike price of Rs.330 was up by Rs.2.85 or 38.51% to Rs. 10.25 with volume of 16440 lots & OI of 6873 lots, while NATURAL GAS Put Option June-2025 contract at Strike price of Rs.320 was down by Rs.2.95 or 26.46% to Rs. 8.2 with volume of 16786 lots & OI of 9421 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option June-2025 contract at Strike price of Rs.100000 was up by Rs.81.5 or 7.61% to Rs. 1153 with volume of 1356 lots & OI of 1076 lots, while GOLD Put Option June-2025 contract at Strike price of Rs.99000 was down by Rs.144.5 or 10.88% to Rs. 1184 with volume of 1217 lots & OI of 490 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.110000 was up by Rs.510 or 76.69% to Rs. 1175 with volume of 2019 lots & OI of 1853 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.106000 was down by Rs.785 or 53.2% to Rs. 690.5 with volume of 3206 lots & OI of 1083 lots.