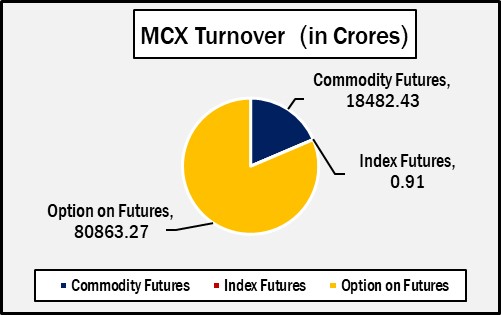

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.99346.61 crores in various futures & option contracts for commodities listed at MCX on Tuesday, May 13, 2025 till 4:45 pm. In which commodity futures accounted for Rs. 18482.43 crores and options on commodity futures for Rs. 80863.27 crores (notional). Bullion Index MCXBULLDEX May-25 futures was reached at 21725.

Commodity Future Contracts:

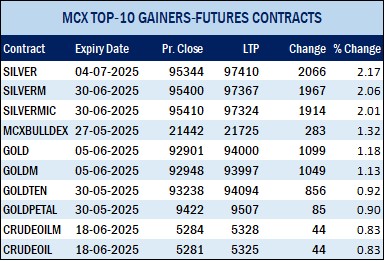

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 15080.35 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was up by Rs.1099 or 1.18% to Rs. 94000 per 10 gram, GOLDTEN May-2025 contract was up by Rs.860 or 0.92% to Rs. 94098 per 10 gram, GOLDGUINEA May-2025 contract was up by Rs.518 or 0.69% to Rs. 75558 per 8 gram and GOLDPETAL May-2025 contract was up by Rs.83 or 0.88% to Rs. 9505 per gram. On other hand, GOLDM June-2025 contract was up by Rs.1038 or 1.12% to Rs. 93986 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.2037 or 2.14% to Rs. 97381 per kg, while SILVERM June-2025 contract was up by Rs.1937 or 2.03% to Rs. 97337 per kg and SILVERMIC June-2025 contract was up by Rs.1894 or 1.99% to Rs. 97304 per kg.

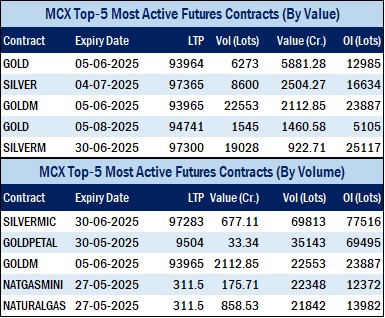

GOLD futures clocked turnover of Rs. 7378.10 crores with volume of 7856 lots and OI of 18284 lots while SILVER futures clocked turnover of Rs. 2688.57 crores with volume of 9223 lots and OI of 17774 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1615.68 crores. COPPER May-2025 contract was up by Rs.6.6 or 0.78% to Rs. 857.9 per kg and ZINC May-2025 contract was up by Rs.1.6 or 0.63% to Rs. 253.75 per kg while ALUMINIUM May-2025 contract was up by Rs.1.85 or 0.78% to Rs. 239.2 per kg and LEAD May-2025 contract was up by Rs.0.65 or 0.37% to Rs. 178.5 per kg.

COPPER futures clocked turnover of Rs. 1109.21 crores, ALUMINIUM futures Rs. 185.16 crores, LEAD futures Rs. 35.06 crores, and ZINC futures clocked turnover of Rs. 184.83 crores.

Energy: Turnover of energy futures products contributed for Rs. 1772.92 crores. CRUDEOIL May-2025 contract was up by Rs.41 or 0.77% to Rs. 5333 per BBL while NATURALGAS May-2025 contract was up by Rs.1.6 or 0.52% to Rs. 311.6 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 565.99 crores and NATURAL GAS futures Rs. 938.15 crores.

AGRI: MENTHAOIL May-2025 contract was up by Rs.0.6 or 0.07% to Rs. 915 per kg and COTTONCNDY May-2025 contract was down by Rs.440 or 0.82% to Rs. 53540 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 80863.27 crores turnover (notional), having premium turnover of Rs. 1045.55 crores.

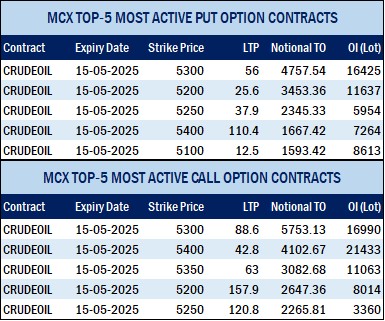

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option May contract at Strike price of Rs.5300 was up by Rs.16.2 or 22.63% to Rs. 87.80 with volume of 113024 lots & OI of 17015 lots, while CRUDE OIL Put Option May-2025 contract at Strike price of Rs.5300 was down by Rs.22.9 or 28.55% to Rs. 57.3 with volume of 97405 lots & OI of 16885 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option May contract at Strike price of Rs.320 was up by Rs.0.35 or 3.38% to Rs. 10.70 with volume of 15182 lots & OI of 6688 lots, while NATURAL GAS Put Option May-2025 contract at Strike price of Rs.310 was down by Rs.0.45 or 3.08% to Rs. 14.15 with volume of 17330 lots & OI of 4841 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option May-2025 contract at Strike price of Rs.94000 was up by Rs.471 or 46.66% to Rs. 1480.5 with volume of 1981 lots & OI of 440 lots, while GOLD Put Option May-2025 contract at Strike price of Rs.92000 was down by Rs.385 or 36.29% to Rs. 676 with volume of 1710 lots & OI of 799 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.97000 was up by Rs.870.5 or 36.82% to Rs. 3235 with volume of 685 lots & OI of 300 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.97000 was down by Rs.1127.5 or 27.86% to Rs. 2920 with volume of 919 lots & OI of 175 lots.