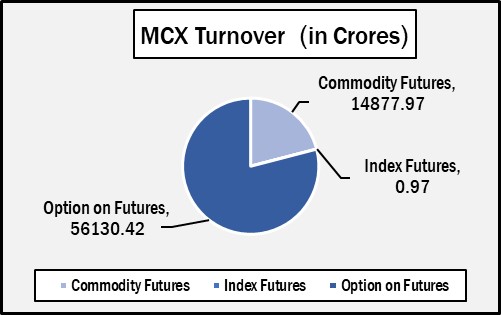

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.71009.36 crores in various futures & option contracts for commodities listed at MCX on Monday, May 05, 2025 till 5:00 pm. In which commodity futures accounted for Rs. 14877.97 crores and options on commodity futures for Rs. 56130.42 crores (notional). Bullion Index MCXBULLDEX May-25 futures was reached at 21659.

Commodity Future Contracts:

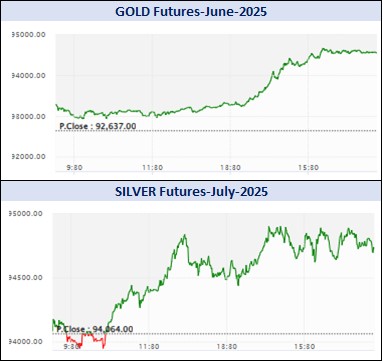

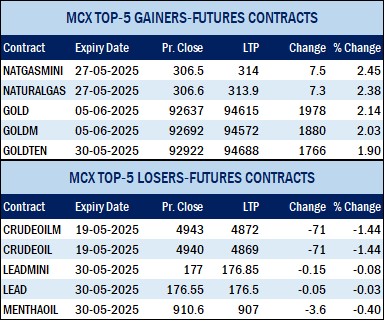

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 12321.50 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was up by Rs.1978 or 2.14% to Rs. 94615 per 10 gram, GOLDTEN May-2025 contract was up by Rs.1766 or 1.9% to Rs. 94688 per 10 gram, GOLDGUINEA May-2025 contract was up by Rs.1260 or 1.68% to Rs. 76095 per 8 gram and GOLDPETAL May-2025 contract was up by Rs.160 or 1.7% to Rs. 9546 per gram. On other hand, GOLDM June-2025 contract was up by Rs.1888 or 2.04% to Rs. 94580 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.750 or 0.8% to Rs. 94814 per kg, while SILVERM June-2025 contract was up by Rs.744 or 0.79% to Rs. 94894 per kg and SILVERMIC June-2025 contract was up by Rs.735 or 0.78% to Rs. 94910 per kg.

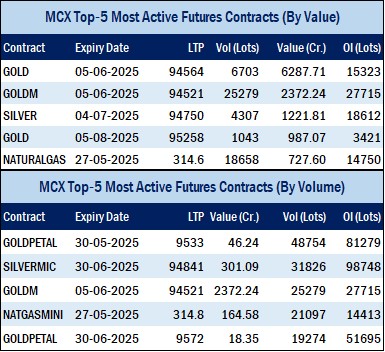

GOLD futures clocked turnover of Rs. 7192.69 crores with volume of 7659 lots and OI of 18888 lots while SILVER futures clocked turnover of Rs. 1241.90 crores with volume of 4374 lots and OI of 19585 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 607.00 crores. COPPER May-2025 contract was up by Rs.4.3 or 0.51% to Rs. 845.55 per kg and ZINC May-2025 contract was up by Rs.0.3 or 0.12% to Rs. 246 per kg while ALUMINIUM May-2025 contract was up by Rs.0.2 or 0.09% to Rs. 232.85 per kg and LEAD May-2025 contract was down by Rs.0.05 or 0.03% to Rs. 176.5 per kg.

COPPER futures clocked turnover of Rs. 371.14 crores, ALUMINIUM futures Rs. 52.19 crores, LEAD futures Rs. 13.06 crores, and ZINC futures clocked turnover of Rs. 114.31 crores.

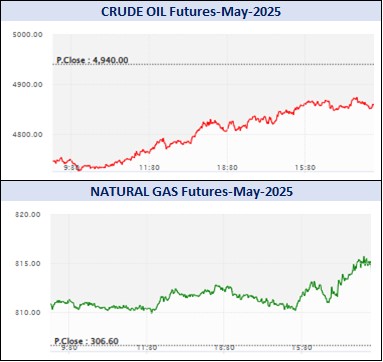

Energy: Turnover of energy futures products contributed for Rs. 1764.59 crores. CRUDEOIL May-2025 contract was down by Rs.71 or 1.44% to Rs. 4869 per BBL while NATURALGAS May-2025 contract was up by Rs.7.5 or 2.45% to Rs. 314.1 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 700.27 crores and NATURAL GAS futures Rs. 774.56 crores.

AGRI: MENTHAOIL May-2025 contract was up by Rs.0.3 or 0.03% to Rs. 911 per kg .

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 56130.42 crores turnover (notional), having premium turnover of Rs. 1147.22 crores.

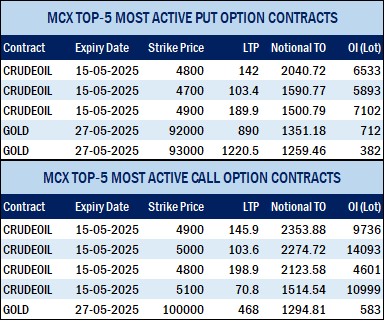

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option May contract at Strike price of Rs.4900 was down by Rs.79.4 or 34.93% to Rs. 147.90 with volume of 45213 lots & OI of 9752 lots, while CRUDE OIL Put Option May-2025 contract at Strike price of Rs.4800 was down by Rs.10.7 or 7.14% to Rs. 139.1 with volume of 39567 lots & OI of 6367 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option May contract at Strike price of Rs.310 was up by Rs.5.1 or 28.1% to Rs. 23.25 with volume of 10507 lots & OI of 2631 lots, while NATURAL GAS Put Option May-2025 contract at Strike price of Rs.310 was down by Rs.3.45 or 15.97% to Rs. 18.15 with volume of 7649 lots & OI of 2369 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option May-2025 contract at Strike price of Rs.100000 was up by Rs.238.5 or 100.85% to Rs. 475 with volume of 1278 lots & OI of 583 lots, while GOLD Put Option May-2025 contract at Strike price of Rs.92000 was down by Rs.546.5 or 38.22% to Rs. 883.5 with volume of 1440 lots & OI of 706 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.95000 was up by Rs.316.5 or 11.15% to Rs. 3154.5 with volume of 499 lots & OI of 501 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.90000 was down by Rs.159 or 10.65% to Rs. 1334 with volume of 164 lots & OI of 494 lots.