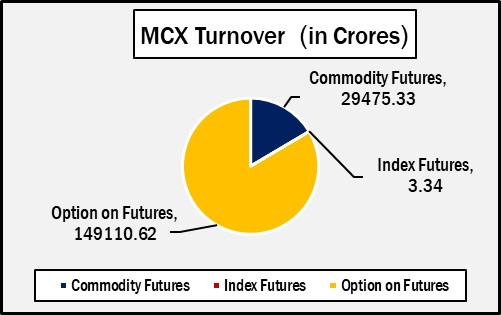

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.178589.28 crores in various futures & option contracts for commodities listed at MCX on Tuesday, June 24, 2025 till 5:00 pm. In which commodity futures accounted for Rs. 29475.33 crores and options on commodity futures for Rs. 149110.62 crores (notional). Bullion Index MCXBULLDEX Jun-25 futures was reached at 22704.

Commodity Future Contracts:

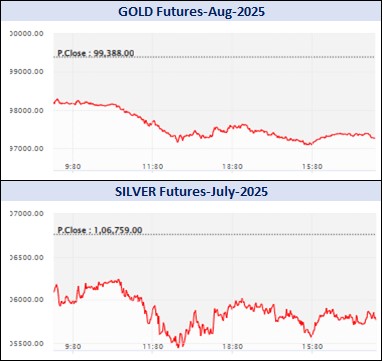

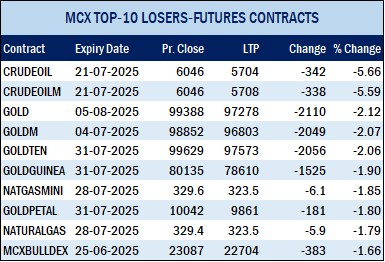

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 23162.93 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was down by Rs.2110 or 2.12% to Rs. 97278 per 10 gram, GOLDTEN June-2025 contract was down by Rs.2095 or 2.11% to Rs. 97000 per 10 gram, GOLDGUINEA June-2025 contract was down by Rs.1863 or 2.33% to Rs. 78007 per 8 gram and GOLDPETAL June-2025 contract was down by Rs.196 or 1.96% to Rs. 9797 per gram. On other hand, GOLDM July-2025 contract was down by Rs.2049 or 2.07% to Rs. 96803 per 10 gram.

SILVER futures, with July expiry contract was down by Rs.941 or 0.88% to Rs. 105818 per kg, while SILVERM June-2025 contract was down by Rs.1163 or 1.09% to Rs. 105111 per kg and SILVERMIC June-2025 contract was down by Rs.1156 or 1.09% to Rs. 105168 per kg.

GOLD futures clocked turnover of Rs. 11643.06 crores with volume of 11914 lots and OI of 15064 lots while SILVER futures clocked turnover of Rs. 2673.57 crores with volume of 8385 lots and OI of 19884 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1829.47 crores. COPPER June-2025 contract was up by Rs.0.35 or 0.04% to Rs. 881.4 per kg and ZINC June-2025 contract was up by Rs.0.8 or 0.31% to Rs. 255.75 per kg while ALUMINIUM June-2025 contract was down by Rs.1.5 or 0.6% to Rs. 247.15 per kg and LEAD June-2025 contract was down by Rs.1.4 or 0.78% to Rs. 178.05 per kg.

COPPER futures clocked turnover of Rs. 1189.66 crores, ALUMINIUM futures Rs. 223.59 crores, LEAD futures Rs. 19.30 crores, and ZINC futures clocked turnover of Rs. 288.33 crores.

Energy: Turnover of energy futures products contributed for Rs. 4376.70 crores. CRUDEOIL July-2025 contract was down by Rs.342 or 5.66% to Rs. 5704 per BBL while NATURALGAS June-2025 contract was down by Rs.5.3 or 1.66% to Rs. 313.7 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 2341.50 crores and NATURAL GAS futures Rs. 1442.71 crores.

AGRI: MENTHAOIL June-2025 contract was down by Rs.0.1 or 0.01% to Rs. 915 per kg and COTTONCNDY July-2025 contract was up by Rs.290 or 0.55% to Rs. 53500 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 149110.62 crores turnover (notional), having premium turnover of Rs. 2201.61 crores.

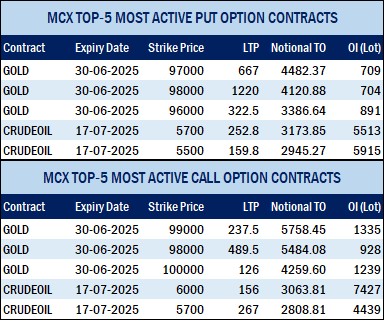

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option July contract at Strike price of Rs.6000 was down by Rs.190.9 or 55.66% to Rs. 152.10 with volume of 49259 lots & OI of 7381 lots, while CRUDE OIL Put Option July-2025 contract at Strike price of Rs.5700 was up by Rs.92.9 or 56% to Rs. 258.8 with volume of 52583 lots & OI of 5600 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option July contract at Strike price of Rs.330 was down by Rs.2.65 or 12.07% to Rs. 19.30 with volume of 9068 lots & OI of 1769 lots, while NATURAL GAS Put Option July-2025 contract at Strike price of Rs.320 was up by Rs.2.65 or 15.14% to Rs. 20.15 with volume of 10673 lots & OI of 1983 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option June-2025 contract at Strike price of Rs.99000 was down by Rs.820 or 77.43% to Rs. 239 with volume of 5795 lots & OI of 1335 lots, while GOLD Put Option June-2025 contract at Strike price of Rs.97000 was up by Rs.499.5 or 286.25% to Rs. 674 with volume of 4579 lots & OI of 711 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.107000 was down by Rs.474.5 or 72.72% to Rs. 178 with volume of 6527 lots & OI of 1307 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.106000 was up by Rs.292 or 65.47% to Rs. 738 with volume of 6335 lots & OI of 765 lots.