Mumbai: The country’s leading commodity derivatives exchange, MCX, had its first session closed on May 1 due to a public holiday for Maharashtra Day, while the second session operated as usual. Notably, on April 30, Akshaya Tritiya, the session running until 11:30 PM recorded a historic high turnover of Rs.5,83,572.04 crore across 24,00,727 trades in various commodity futures, options, and index futures, with a total of 39,74,895 lots traded. Previously, the exchange had recorded its highest turnover of Rs.5,03,335 crore on January 13, 2025, but this Akshaya Tritiya set a new record. This record turnover included Rs.50,398.08 crore in commodity futures and a peak notional turnover of Rs.5,33,172.13 crore in commodity options.

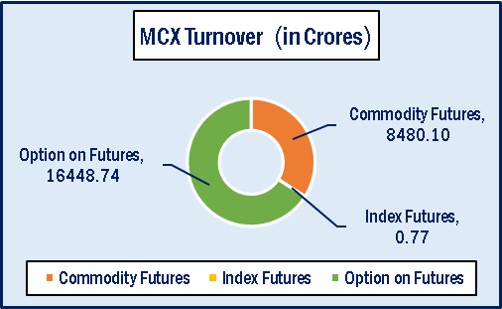

MCX has recorded turnover of Rs.24929.6 crores in various futures & option contracts for commodities listed at MCX on Thursday, May 01, 2025 till 5:30 pm. In which commodity futures accounted for Rs. 8480.1 crores and options on commodity futures for Rs. 16448.74 crores (notional). Bullion Index MCXBULLDEX May-25 futures was reached at 21254.

Commodity Future Contracts:

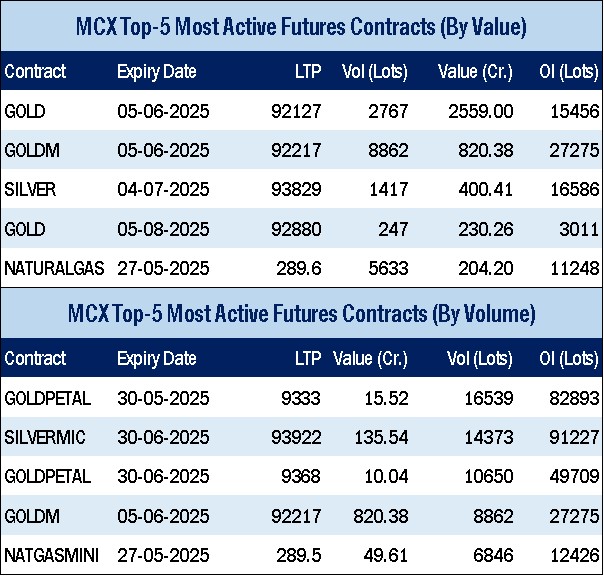

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 4722.27 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was down by Rs.2575 or 2.72% to Rs. 92127 per 10 gram, GOLDTEN May-2025 contract was down by Rs.2427 or 2.56% to Rs. 92522 per 10 gram, GOLDGUINEA May-2025 contract was down by Rs.1882 or 2.47% to Rs. 74438 per 8 gram and GOLDPETAL May-2025 contract was down by Rs.243 or 2.54% to Rs. 9333 per gram. On other hand, GOLDM May-2025 contract was down by Rs.2129 or 2.25% to Rs. 92436 per 10 gram.

SILVER futures, with May expiry contract was down by Rs.1903 or 2.01% to Rs. 92761 per kg, while SILVERM June-2025 contract was down by Rs.2029 or 2.12% to Rs. 93903 per kg and SILVERMIC June-2025 contract was down by Rs.2032 or 2.12% to Rs. 93922 per kg.

GOLD futures clocked turnover of Rs. 2805.23 crores with volume of 3031 lots and OI of 18584 lots while SILVER futures clocked turnover of Rs. 431.40 crores with volume of 1525 lots and OI of 17706 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 174.81 crores. COPPER May-2025 contract was up by Rs.1.7 or 0.21% to Rs. 825.3 per kg and ZINC May-2025 contract was up by Rs.0.85 or 0.35% to Rs. 245 per kg while ALUMINIUM May-2025 contract was up by Rs.0.8 or 0.35% to Rs. 230.35 per kg and LEAD May-2025 contract was up by Rs.0.2 or 0.11% to Rs. 176.95 per kg.

COPPER futures clocked turnover of Rs. 113.53 crores, ALUMINIUM futures Rs. 13.61 crores, LEAD futures Rs. 1.33 crores, and ZINC futures clocked turnover of Rs. 27.75 crores.

Energy: Turnover of energy futures products contributed for Rs. 447.21 crores. CRUDEOIL May-2025 contract was down by Rs.115 or 2.32% to Rs. 4837 per BBL while NATURALGAS May-2025 contract was up by Rs.8.7 or 3.1% to Rs. 289.6 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 147.61 crores and NATURAL GAS futures Rs. 224.44 crores.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 16448.74 crores turnover (notional), having premium turnover of Rs. 376.45 crores.

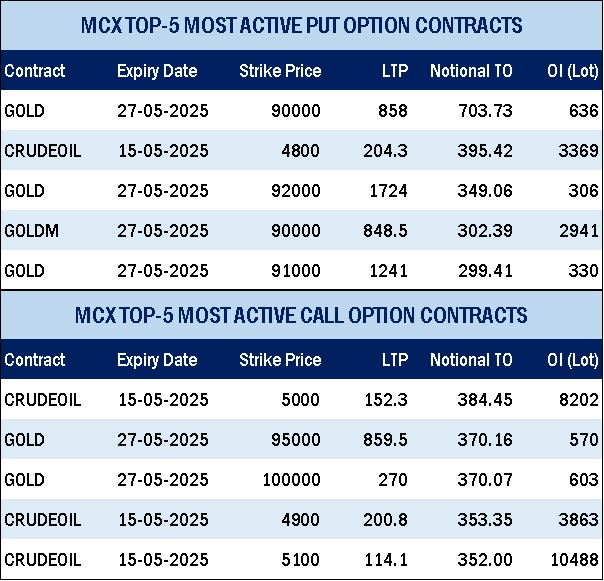

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option May contract at Strike price of Rs.5000 was down by Rs.35.2 or 18.59% to Rs. 154.20 with volume of 6818 lots & OI of 8027 lots, while CRUDE OIL Put Option May-2025 contract at Strike price of Rs.4800 was up by Rs.45.6 or 28.97% to Rs. 203 with volume of 7476 lots & OI of 3349 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option May contract at Strike price of Rs.290 was up by Rs.3.7 or 23.72% to Rs. 19.30 with volume of 3673 lots & OI of 2828 lots, while NATURAL GAS Put Option May-2025 contract at Strike price of Rs.290 was down by Rs.3.65 or 14.87% to Rs. 20.9 with volume of 3008 lots & OI of 2330 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option May-2025 contract at Strike price of Rs.100000 was down by Rs.237.5 or 47.08% to Rs. 267 with volume of 348 lots & OI of 596 lots, while GOLD Put Option May-2025 contract at Strike price of Rs.90000 was up by Rs.487 or 125.35% to Rs. 875.5 with volume of 736 lots & OI of 650 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.95000 was down by Rs.1035 or 26.57% to Rs. 2861 with volume of 131 lots & OI of 323 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.95000 was up by Rs.1468.5 or 49.42% to Rs. 4440 with volume of 136 lots & OI of 444 lots.