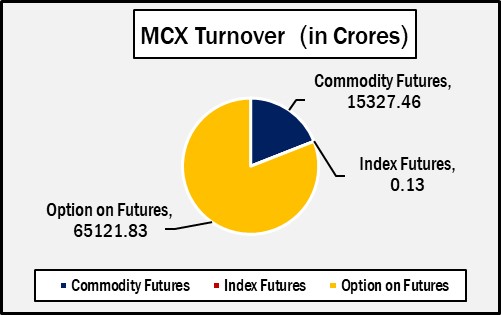

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.80449.42 crores in various futures & option contracts for commodities listed at MCX on Tuesday, May 20, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 15327.46 crores and options on commodity futures for Rs. 65121.83 crores (notional). Bullion Index MCXBULLDEX May-25 futures was reached at 21518.

Commodity Future Contracts:

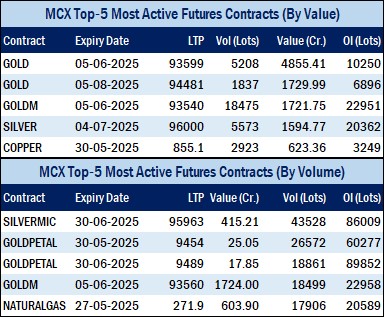

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 12263.09 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was up by Rs.303 or 0.32% to Rs. 93600 per 10 gram, GOLDTEN May-2025 contract was up by Rs.219 or 0.23% to Rs. 93681 per 10 gram, GOLDGUINEA May-2025 contract was up by Rs.98 or 0.13% to Rs. 75132 per 8 gram and GOLDPETAL May-2025 contract was up by Rs.17 or 0.18% to Rs. 9454 per gram. On other hand, GOLDM June-2025 contract was up by Rs.246 or 0.26% to Rs. 93560 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.549 or 0.58% to Rs. 96002 per kg, while SILVERM June-2025 contract was up by Rs.453 or 0.47% to Rs. 95955 per kg and SILVERMIC June-2025 contract was up by Rs.449 or 0.47% to Rs. 95963 per kg.

GOLD futures clocked turnover of Rs. 6702.11 crores with volume of 7168 lots and OI of 17357 lots while SILVER futures clocked turnover of Rs. 1726.94 crores with volume of 6029 lots and OI of 22037 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1420.39 crores. COPPER May-2025 contract was down by Rs.0.2 or 0.02% to Rs. 855.15 per kg and ZINC May-2025 contract was up by Rs.2 or 0.78% to Rs. 258.6 per kg while ALUMINIUM May-2025 contract was up by Rs.1.55 or 0.66% to Rs. 237.8 per kg and LEAD May-2025 contract was down by Rs.0.05 or 0.03% to Rs. 177.9 per kg.

COPPER futures clocked turnover of Rs. 908.17 crores, ALUMINIUM futures Rs. 115.29 crores, LEAD futures Rs. 40.54 crores, and ZINC futures clocked turnover of Rs. 242.60 crores.

Energy: Turnover of energy futures products contributed for Rs. 1363.55 crores. CRUDEOIL June-2025 contract was up by Rs.33 or 0.62% to Rs. 5332 per BBL while NATURALGAS May-2025 contract was up by Rs.4 or 1.49% to Rs. 271.9 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 422.26 crores and NATURAL GAS futures Rs. 726.51 crores.

AGRI: MENTHAOIL May-2025 contract was up by Rs.3.6 or 0.4% to Rs. 908 per kg and COTTONCNDY May-2025 contract was down by Rs.40 or 0.07% to Rs. 53900 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 65121.83 crores turnover (notional), having premium turnover of Rs. 941.66 crores.

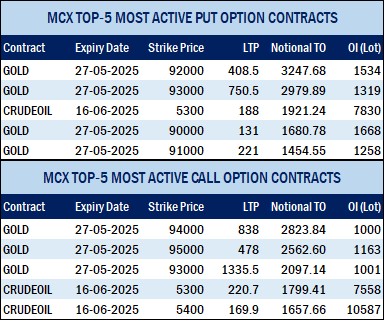

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option June contract at Strike price of Rs.5300 was up by Rs.13 or 6.3% to Rs. 219.50 with volume of 32507 lots & OI of 7584 lots, while CRUDE OIL Put Option June-2025 contract at Strike price of Rs.5300 was down by Rs.22.2 or 10.46% to Rs. 190 with volume of 34864 lots & OI of 7806 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option May contract at Strike price of Rs.270 was up by Rs.1.6 or 20.38% to Rs. 9.45 with volume of 30228 lots & OI of 9559 lots, while NATURAL GAS Put Option May-2025 contract at Strike price of Rs.270 was down by Rs.2.1 or 21.11% to Rs. 7.85 with volume of 21347 lots & OI of 10925 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option May-2025 contract at Strike price of Rs.94000 was up by Rs.35 or 4.4% to Rs. 831 with volume of 2968 lots & OI of 995 lots, while GOLD Put Option May-2025 contract at Strike price of Rs.92000 was down by Rs.160.5 or 28.26% to Rs. 407.5 with volume of 3498 lots & OI of 1531 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.96000 was up by Rs.240 or 9.5% to Rs. 2767.5 with volume of 606 lots & OI of 446 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.95000 was down by Rs.244.5 or 9.95% to Rs. 2214 with volume of 443 lots & OI of 531 lots.