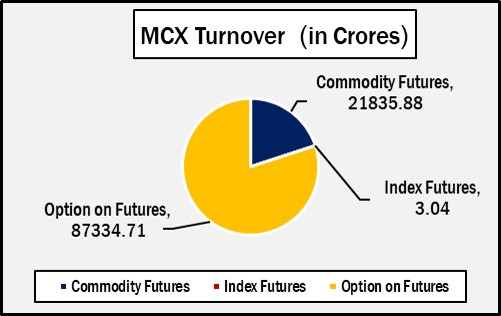

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.109173.63 crores in various futures & option contracts for commodities listed at MCX on Thursday, June 19, 2025 till 5:00 pm. In which commodity futures accounted for Rs. 21835.88 crores and options on commodity futures for Rs. 87334.71 crores (notional). Bullion Index MCXBULLDEX Jun-25 futures was reached at 23095.

Commodity Future Contracts:

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 18265.33 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was down by Rs.117 or 0.12% to Rs. 99420 per 10 gram, GOLDTEN June-2025 contract was down by Rs.191 or 0.19% to Rs. 99067 per 10 gram, GOLDGUINEA June-2025 contract was up by Rs.14 or 0.02% to Rs. 79694 per 8 gram and GOLDPETAL June-2025 contract was down by Rs.18 or 0.18% to Rs. 9971 per gram. On other hand, GOLDM July-2025 contract was down by Rs.141 or 0.14% to Rs. 98904 per 10 gram.

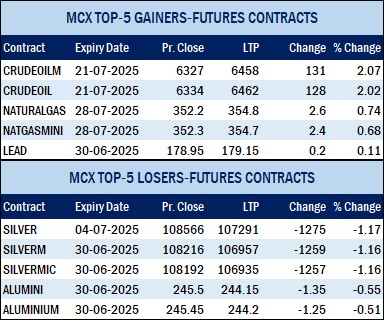

SILVER futures, with July expiry contract was down by Rs.1275 or 1.17% to Rs. 107291 per kg, while SILVERM June-2025 contract was down by Rs.1241 or 1.15% to Rs. 106975 per kg and SILVERMIC June-2025 contract was down by Rs.1269 or 1.17% to Rs. 106923 per kg.

GOLD futures clocked turnover of Rs. 7569.71 crores with volume of 7633 lots and OI of 16367 lots while SILVER futures clocked turnover of Rs. 3809.27 crores with volume of 11770 lots and OI of 22465 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1114.79 crores. COPPER June-2025 contract was down by Rs.2.1 or 0.24% to Rs. 877.8 per kg and ZINC June-2025 contract was down by Rs.0.55 or 0.22% to Rs. 252.45 per kg while ALUMINIUM June-2025 contract was down by Rs.1.25 or 0.51% to Rs. 244.2 per kg and LEAD June-2025 contract was up by Rs.0.2 or 0.11% to Rs. 179.15 per kg.

COPPER futures clocked turnover of Rs. 616.46 crores, ALUMINIUM futures Rs. 182.71 crores, LEAD futures Rs. 22.63 crores, and ZINC futures clocked turnover of Rs. 206.72 crores.

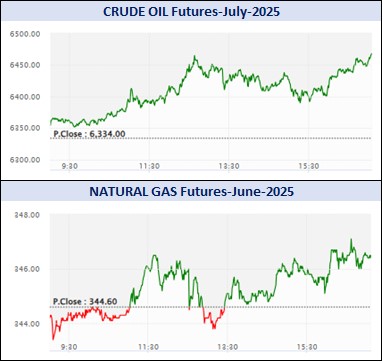

Energy: Turnover of energy futures products contributed for Rs. 2466.21 crores. CRUDEOIL July-2025 contract was up by Rs.126 or 1.99% to Rs. 6460 per BBL while NATURALGAS June-2025 contract was up by Rs.1.8 or 0.52% to Rs. 346.4 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 989.87 crores and NATURAL GAS futures Rs. 1106.15 crores.

AGRI: MENTHAOIL June-2025 contract was down by Rs.2.5 or 0.27% to Rs. 920 per kg and COTTONCNDY July-2025 contract was down by Rs.150 or 0.28% to Rs. 53000 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 87334.71 crores turnover (notional), having premium turnover of Rs. 1265.38 crores. CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option July contract at Strike price of Rs.6400 was up by Rs.44.2 or 9.93% to Rs. 489.40 with volume of 12468 lots & OI of 4048 lots, while CRUDE OIL Put Option July-2025 contract at Strike price of Rs.6400 was down by Rs.56.1 or 10.91% to Rs. 457.9 with volume of 7305 lots & OI of 1860 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option June contract at Strike price of Rs.350 was up by Rs.0.55 or 7.91% to Rs. 7.50 with volume of 21238 lots & OI of 10642 lots, while NATURAL GAS Put Option June-2025 contract at Strike price of Rs.340 was down by Rs.0.7 or 9.66% to Rs. 6.55 with volume of 17666 lots & OI of 10116 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option June-2025 contract at Strike price of Rs.100000 was down by Rs.117 or 10.81% to Rs. 965.5 with volume of 2546 lots & OI of 1313 lots, while GOLD Put Option June-2025 contract at Strike price of Rs.98000 was down by Rs.60 or 9.64% to Rs. 562.5 with volume of 2518 lots & OI of 947 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.110000 was down by Rs.366.5 or 39.14% to Rs. 570 with volume of 5026 lots & OI of 2209 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.107000 was up by Rs.313.5 or 38.12% to Rs. 1136 with volume of 3264 lots & OI of 465 lots.