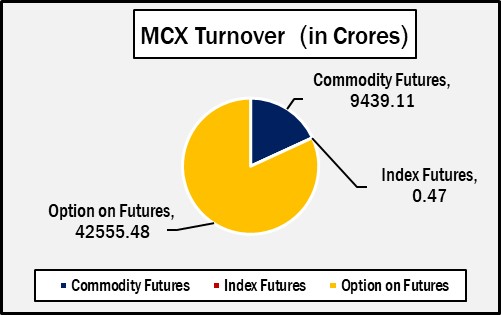

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.51995.07 crores in various futures & option contracts for commodities listed at MCX on Friday, July 04, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 9439.11 crores and options on commodity futures for Rs. 42555.48 crores (notional). Bullion Index MCXBULLDEX Jul-25 futures was reached at 22627.

Commodity Future Contracts:

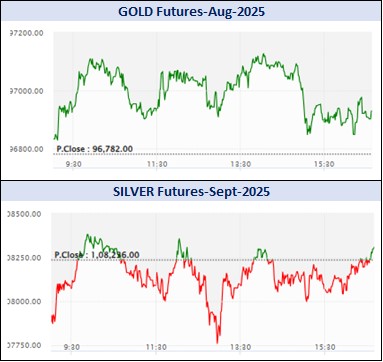

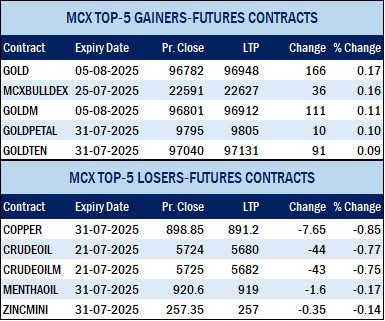

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 6605.67 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was up by Rs.166 or 0.17% to Rs. 96948 per 10 gram, GOLDTEN July-2025 contract was up by Rs.91 or 0.09% to Rs. 97131 per 10 gram, GOLDGUINEA July-2025 contract was up by Rs.34 or 0.04% to Rs. 78010 per 8 gram and GOLDPETAL July-2025 contract was up by Rs.10 or 0.1% to Rs. 9805 per gram. On other hand, GOLDM July-2025 contract was up by Rs.187 or 0.19% to Rs. 96720 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.23 or 0.02% to Rs. 107308 per kg, while SILVERM August-2025 contract was up by Rs.65 or 0.06% to Rs. 108144 per kg and SILVERMIC August-2025 contract was up by Rs.65 or 0.06% to Rs. 108150 per kg.

GOLD futures clocked turnover of Rs. 2895.60 crores with volume of 2983 lots and OI of 15067 lots while SILVER futures clocked turnover of Rs. 1261.13 crores with volume of 3885 lots and OI of 17240 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1714.26 crores. COPPER July-2025 contract was down by Rs.7.65 or 0.85% to Rs. 891.2 per kg and ZINC July-2025 contract was down by Rs.0.35 or 0.14% to Rs. 257.1 per kg while ALUMINIUM July-2025 contract was down by Rs.0.35 or 0.14% to Rs. 248.8 per kg and LEAD July-2025 contract was down by Rs.0.1 or 0.06% to Rs. 181.3 per kg.

COPPER futures clocked turnover of Rs. 1447.52 crores, ALUMINIUM futures Rs. 79.79 crores, LEAD futures Rs. 28.04 crores, and ZINC futures clocked turnover of Rs. 108.21 crores.

Energy: Turnover of energy futures products contributed for Rs. 1254.40 crores. CRUDEOIL July-2025 contract was down by Rs.44 or 0.77% to Rs. 5680 per BBL while NATURALGAS July-2025 without any changes 292.5 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 327.01 crores and NATURAL GAS futures Rs. 717.22 crores.

AGRI: MENTHAOIL July-2025 contract was down by Rs.1.6 or 0.17% to Rs. 919 per kg .

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 42555.48 crores turnover (notional), having premium turnover of Rs. 757.22 crores.

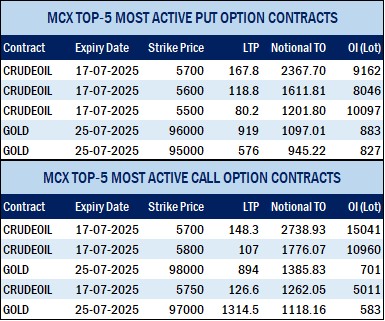

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option July contract at Strike price of Rs.5700 was down by Rs.22.8 or 13.35% to Rs. 148.00 with volume of 46599 lots & OI of 15061 lots, while CRUDE OIL Put Option July-2025 contract at Strike price of Rs.5700 was up by Rs.21.1 or 14.42% to Rs. 167.4 with volume of 40301 lots & OI of 9090 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option July contract at Strike price of Rs.290 was down by Rs.0.4 or 2.31% to Rs. 16.95 with volume of 9888 lots & OI of 5505 lots, while NATURAL GAS Put Option July-2025 contract at Strike price of Rs.290 was down by Rs.0.6 or 4% to Rs. 14.4 with volume of 12150 lots & OI of 5277 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option July-2025 contract at Strike price of Rs.98000 was up by Rs.10 or 1.14% to Rs. 890 with volume of 1391 lots & OI of 698 lots, while GOLD Put Option July-2025 contract at Strike price of Rs.96000 was down by Rs.70.5 or 7.05% to Rs. 929 with volume of 1127 lots & OI of 871 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option July contract at Strike price of Rs.110000 was down by Rs.7.5 or 0.39% to Rs. 1899 with volume of 352 lots & OI of 1284 lots, while SILVER Put Option July-2025 contract at Strike price of Rs.106000 was down by Rs.50.5 or 3.06% to Rs. 1600 with volume of 422 lots & OI of 646 lots.