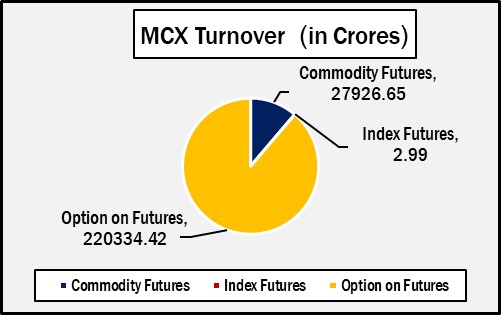

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.248264.06 crores in various futures & option contracts for commodities listed at MCX on Friday, June 13, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 27926.65 crores and options on commodity futures for Rs. 220334.42 crores (notional). Bullion Index MCXBULLDEX Jun-25 futures was reached at 23105.

Commodity Future Contracts:

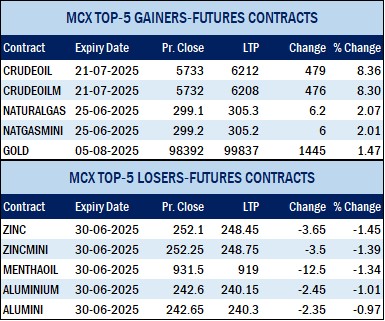

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 19103.75 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was up by Rs.1445 or 1.47% to Rs. 99837 per 10 gram, GOLDTEN June-2025 contract was up by Rs.1401 or 1.43% to Rs. 99370 per 10 gram, GOLDGUINEA June-2025 contract was up by Rs.1087 or 1.38% to Rs. 79669 per 8 gram and GOLDPETAL June-2025 contract was up by Rs.122 or 1.24% to Rs. 9970 per gram. On other hand, GOLDM July-2025 contract was up by Rs.1380 or 1.41% to Rs. 99166 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.243 or 0.23% to Rs. 106128 per kg, while SILVERM June-2025 contract was up by Rs.252 or 0.24% to Rs. 105874 per kg and SILVERMIC June-2025 contract was up by Rs.252 or 0.24% to Rs. 105857 per kg.

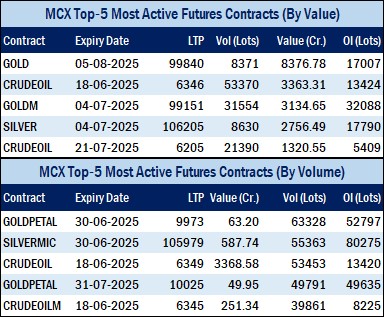

GOLD futures clocked turnover of Rs. 8984.53 crores with volume of 8972 lots and OI of 17991 lots while SILVER futures clocked turnover of Rs. 3173.41 crores with volume of 9917 lots and OI of 22920 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1859.81 crores. COPPER June-2025 contract was down by Rs.6.85 or 0.78% to Rs. 868 per kg and ZINC June-2025 contract was down by Rs.3.65 or 1.45% to Rs. 248.45 per kg while ALUMINIUM June-2025 contract was down by Rs.2.45 or 1.01% to Rs. 240.15 per kg and LEAD June-2025 contract was down by Rs.0.35 or 0.19% to Rs. 179.25 per kg.

COPPER futures clocked turnover of Rs. 968.30 crores, ALUMINIUM futures Rs. 172.44 crores, LEAD futures Rs. 57.01 crores, and ZINC futures clocked turnover of Rs. 526.42 crores.

Energy: Turnover of energy futures products contributed for Rs. 6726.53 crores. CRUDEOIL June-2025 contract was up by Rs.512 or 8.76% to Rs. 6356 per BBL while NATURALGAS June-2025 contract was up by Rs.6.2 or 2.07% to Rs. 305.3 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 4866.03 crores and NATURAL GAS futures Rs. 1211.74 crores.

AGRI: MENTHAOIL June-2025 contract was down by Rs.10.4 or 1.12% to Rs. 921 per kg .

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 220334.42 crores turnover (notional), having premium turnover of Rs. 4167.03 crores.

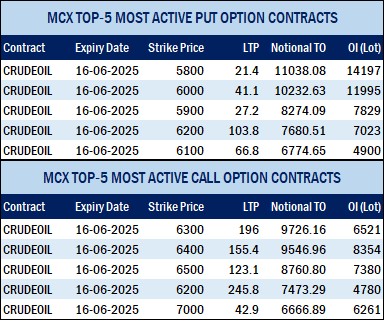

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option June contract at Strike price of Rs.6300 was up by Rs.180.4 or 1141.77% to Rs. 196.20 with volume of 148216 lots & OI of 6471 lots, while CRUDE OIL Put Option June-2025 contract at Strike price of Rs.5800 was down by Rs.59.8 or 73.74% to Rs. 21.3 with volume of 188861 lots & OI of 14005 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option June contract at Strike price of Rs.310 was up by Rs.2.35 or 30.13% to Rs. 10.15 with volume of 22918 lots & OI of 9405 lots, while NATURAL GAS Put Option June-2025 contract at Strike price of Rs.300 was down by Rs.2.65 or 21.29% to Rs. 9.8 with volume of 24696 lots & OI of 6124 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option June-2025 contract at Strike price of Rs.100000 was up by Rs.665 or 73.6% to Rs. 1568.5 with volume of 1694 lots & OI of 623 lots, while GOLD Put Option June-2025 contract at Strike price of Rs.98000 was down by Rs.503 or 38.34% to Rs. 809 with volume of 1775 lots & OI of 813 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.106000 was up by Rs.80.5 or 4.11% to Rs. 2037.5 with volume of 2353 lots & OI of 958 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.106000 was down by Rs.204 or 9.88% to Rs. 1860 with volume of 1843 lots & OI of 403 lots.