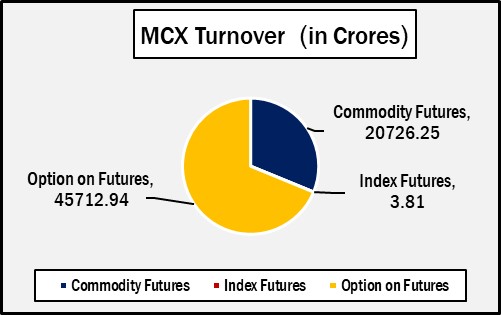

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.66442.99 crores in various futures & option contracts for commodities listed at MCX on Thursday, June 05, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 20726.25 crores and options on commodity futures for Rs. 45712.94 crores (notional). Bullion Index MCXBULLDEX Jun-25 futures was reached at 22875.

Commodity Future Contracts:

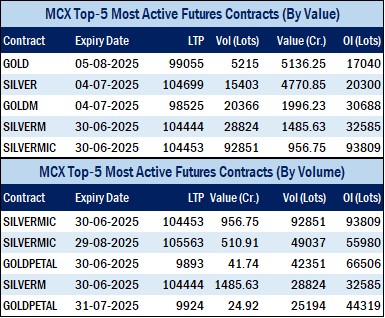

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 18536.48 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was up by Rs.562 or 0.57% to Rs. 99141 per 10 gram, GOLDTEN June-2025 contract was up by Rs.622 or 0.63% to Rs. 98730 per 10 gram, GOLDGUINEA June-2025 contract was up by Rs.515 or 0.66% to Rs. 79074 per 8 gram and GOLDPETAL June-2025 contract was up by Rs.61 or 0.62% to Rs. 9902 per gram. On other hand, GOLDM June-2025 contract was up by Rs.829 or 0.85% to Rs. 98190 per 10 gram.

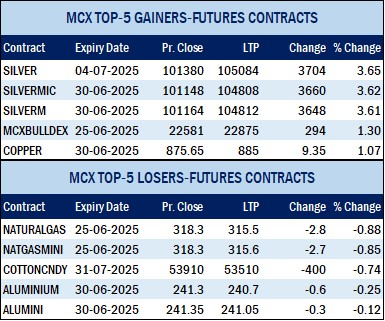

SILVER futures, with July expiry contract was up by Rs.3705 or 3.65% to Rs. 105085 per kg, while SILVERM June-2025 contract was up by Rs.3625 or 3.58% to Rs. 104789 per kg and SILVERMIC June-2025 contract was up by Rs.3637 or 3.6% to Rs. 104785 per kg.

GOLD futures clocked turnover of Rs. 5780.13 crores with volume of 5864 lots and OI of 17771 lots while SILVER futures clocked turnover of Rs. 5737.55 crores with volume of 18474 lots and OI of 23485 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1497.76 crores. COPPER June-2025 contract was up by Rs.9.25 or 1.06% to Rs. 884.9 per kg and ZINC June-2025 contract was up by Rs.0.65 or 0.25% to Rs. 256.6 per kg while ALUMINIUM June-2025 contract was down by Rs.0.5 or 0.21% to Rs. 240.8 per kg and LEAD June-2025 contract was down by Rs.0.1 or 0.06% to Rs. 179.4 per kg.

COPPER futures clocked turnover of Rs. 1017.25 crores, ALUMINIUM futures Rs. 89.40 crores, LEAD futures Rs. 34.01 crores, and ZINC futures clocked turnover of Rs. 244.16 crores.

Energy: Turnover of energy futures products contributed for Rs. 1255.41 crores. CRUDEOIL June-2025 contract was up by Rs.23 or 0.43% to Rs. 5409 per BBL while NATURALGAS June-2025 contract was down by Rs.2.7 or 0.85% to Rs. 315.6 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 287.98 crores and NATURAL GAS futures Rs. 768.76 crores.

AGRI: MENTHAOIL June-2025 contract was up by Rs.0.8 or 0.09% to Rs. 903 per kg and COTTONCNDY July-2025 contract was down by Rs.400 or 0.74% to Rs. 53510 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 45712.94 crores turnover (notional), having premium turnover of Rs. 762.16 crores.

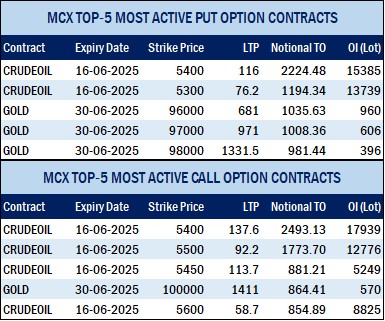

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option June contract at Strike price of Rs.5400 was up by Rs.14.7 or 11.96% to Rs. 137.60 with volume of 45074 lots & OI of 17939 lots, while CRUDE OIL Put Option June-2025 contract at Strike price of Rs.5400 was down by Rs.23.1 or 16.55% to Rs. 116.5 with volume of 40462 lots & OI of 15386 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option June contract at Strike price of Rs.320 was down by Rs.1.2 or 6.98% to Rs. 16.00 with volume of 7464 lots & OI of 6778 lots, while NATURAL GAS Put Option June-2025 contract at Strike price of Rs.320 was up by Rs.0.3 or 1.59% to Rs. 19.2 with volume of 5121 lots & OI of 3720 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option June-2025 contract at Strike price of Rs.100000 was up by Rs.203.5 or 16.85% to Rs. 1411 with volume of 854 lots & OI of 570 lots, while GOLD Put Option June-2025 contract at Strike price of Rs.96000 was down by Rs.128 or 15.94% to Rs. 675 with volume of 1079 lots & OI of 957 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.110000 was up by Rs.769 or 189.88% to Rs. 1174 with volume of 1916 lots & OI of 1275 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.100000 was down by Rs.731.5 or 40.56% to Rs. 1072 with volume of 2576 lots & OI of 1306 lots.