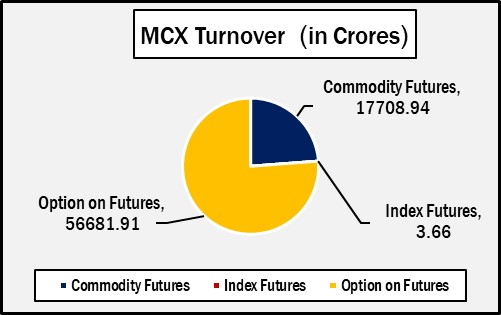

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.74394.51 crores in various futures & option contracts for commodities listed at MCX on Tuesday, July 01, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 17708.94 crores and options on commodity futures for Rs. 56681.91 crores (notional). Bullion Index MCXBULLDEX Jul-25 futures was reached at 22641.

Commodity Future Contracts:

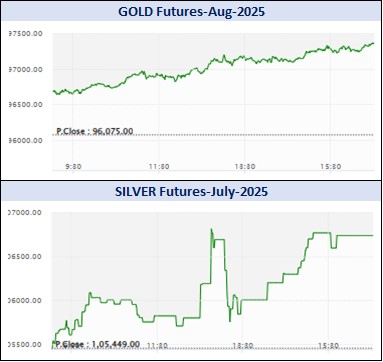

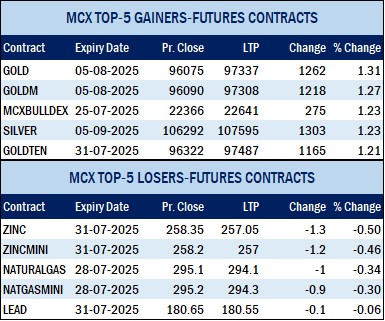

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 13860.12 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was up by Rs.1262 or 1.31% to Rs. 97337 per 10 gram, GOLDTEN July-2025 contract was up by Rs.1165 or 1.21% to Rs. 97487 per 10 gram, GOLDGUINEA July-2025 contract was up by Rs.722 or 0.93% to Rs. 78240 per 8 gram and GOLDPETAL July-2025 contract was up by Rs.99 or 1.02% to Rs. 9833 per gram. On other hand, GOLDM July-2025 contract was up by Rs.1210 or 1.26% to Rs. 96888 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.1289 or 1.22% to Rs. 106738 per kg, while SILVERM August-2025 contract was up by Rs.1232 or 1.16% to Rs. 107469 per kg and SILVERMIC August-2025 contract was up by Rs.1237 or 1.16% to Rs. 107435 per kg.

GOLD futures clocked turnover of Rs. 6143.72 crores with volume of 6329 lots and OI of 15617 lots while SILVER futures clocked turnover of Rs. 2529.02 crores with volume of 7869 lots and OI of 17855 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1409.58 crores. COPPER July-2025 contract was up by Rs.3.75 or 0.42% to Rs. 898.35 per kg and ZINC July-2025 contract was down by Rs.1.3 or 0.5% to Rs. 257.05 per kg while ALUMINIUM July-2025 contract was up by Rs.0.75 or 0.3% to Rs. 249.55 per kg and LEAD July-2025 contract was down by Rs.0.1 or 0.06% to Rs. 180.55 per kg.

COPPER futures clocked turnover of Rs. 979.92 crores, ALUMINIUM futures Rs. 82.36 crores, LEAD futures Rs. 33.28 crores, and ZINC futures clocked turnover of Rs. 225.60 crores.

Energy: Turnover of energy futures products contributed for Rs. 2011.56 crores. CRUDEOIL July-2025 contract was up by Rs.47 or 0.84% to Rs. 5628 per BBL while NATURALGAS July-2025 contract was down by Rs.1 or 0.34% to Rs. 294.1 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 383.20 crores and NATURAL GAS futures Rs. 1305.62 crores.

AGRI: MENTHAOIL July-2025 contract was up by Rs.7.1 or 0.77% to Rs. 929 per kg and COTTONCNDY July-2025 contract was up by Rs.310 or 0.58% to Rs. 54200 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 56681.91 crores turnover (notional), having premium turnover of Rs. 1061.7 crores.

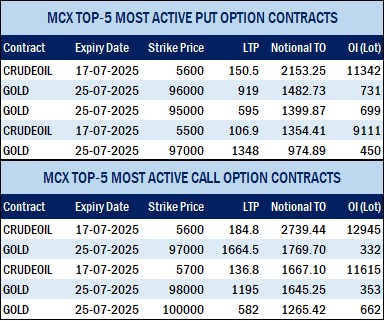

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option July contract at Strike price of Rs.5600 was up by Rs.21.3 or 13.21% to Rs. 182.50 with volume of 44187 lots & OI of 13457 lots, while CRUDE OIL Put Option July-2025 contract at Strike price of Rs.5600 was down by Rs.25.3 or 14.18% to Rs. 153.1 with volume of 36476 lots & OI of 11268 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option July contract at Strike price of Rs.300 was down by Rs.0.1 or 0.62% to Rs. 16.00 with volume of 14279 lots & OI of 6257 lots, while NATURAL GAS Put Option July-2025 contract at Strike price of Rs.290 was up by Rs.0.65 or 4.22% to Rs. 16.05 with volume of 17539 lots & OI of 4708 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option July-2025 contract at Strike price of Rs.97000 was up by Rs.579 or 54.09% to Rs. 1649.5 with volume of 1766 lots & OI of 329 lots, while GOLD Put Option July-2025 contract at Strike price of Rs.96000 was down by Rs.522 or 36.31% to Rs. 915.5 with volume of 1521 lots & OI of 729 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option July contract at Strike price of Rs.110000 was up by Rs.420.5 or 28.47% to Rs. 1897.5 with volume of 771 lots & OI of 1159 lots, while SILVER Put Option July-2025 contract at Strike price of Rs.105000 was down by Rs.458 or 21.7% to Rs. 1653 with volume of 712 lots & OI of 422 lots.